Corporate Strategies

Although prices continue to rise, the Japanese economy is expected to continue its moderate recovery, with personal consumption and inbound demand remaining strong. Furthermore, despite a downward trend in capital investment due to increased uncertainty in the global economy, investments in next-generation technologies are expected to be implemented, leading to a continued recovery. However, due to continued concerns over the sluggish Chinese economy and unpredictable government policies of the United States, the outlook remains uncertain. Under these circumstances, we will implement the following measures to lay the foundation for future growth.

Management

Enhancement of Corporate Governance

We have been committed to improving corporate governance for many years under the conviction that it contributes to enhancing the quality of our company and improving profitability. We took appropriate measures in response to the revisions of the internal control system that were implemented in FY2024. We will strive to raise employee awareness and to improve our internal control system on an ongoing basis.

It is crucial that management always keep these goals in mind, and we are shaping training and policy toward that end.

To continue to respond adequately to changes both inside and outside the organization, we believe it is important to perform a comprehensive evaluation every few years. Recently, we completed an in-depth evaluation of our listing on the Tokyo Stock Exchange and upgrade for our in-house IT systems to support the adoption of digital technology.

These and similar programs significantly enhance the corporation, earning and repaying the trust placed in us by our stakeholders.

Acquiring and Fostering of Human Resources

An important management resource for a trading company is “people. We will continue to focus on recruiting and training excellent human resources.

Regarding recruitment, although it is becoming increasingly difficult to acquire human resources in Japan due to the declining birthrate and aging population, we are striving to recruit both the right number and quality of employees in line with our plans by improving our public image and reviewing our starting salaries and benefits.

As for education, we have been exploring and implementing effective educational methods, and starting in FY2025, we will gradually expand our tiered training programs and strive to build a more comprehensive education system.

Going forward, we will continue to strengthen our recruitment activities to attract talented individuals, regardless of gender or nationality, who will play a central role in the future of Nanyo, while also striving to improve the quality of our human resources through both internal and external training.

Workplace satisfaction

For over 50 years, “creating a rewarding and engaging workplace” has been one of the core principles of our company. As part of our work-style reform efforts, we revised our personnel evaluation system in FY2023 to ensure that employees are evaluated based on their capabilities, regardless of gender. In addition, in response to social demands, we implemented significant wage increases for three consecutive years starting in FY2023 to improve employee motivation and retention, and also revised the programs we offer to support employees in balancing childcare and nursing care responsibilities. We will continue to promote initiatives aimed at developing the next generation of leaders, increasing the number of women in managerial positions, ensuring equal pay for equal work, supporting childcare, and preventing excessive overtime, while striving to improve labor productivity and create a better workplace environment.

Strengthening IR

Since being listed on the Fukuoka Stock Exchange in 1994 and the Tokyo Stock Exchange in 2017, we sought effective IR methods and provided financial information and management strategies to investors. However, in recent years, there has been a growing demand for sustainable corporate value enhancement, and as a result, IR has become more important than ever. Under these circumstances, we updated our website in FY2022 and have been working to enhance the contents, such as by posting information on exhibitions. In FY2025, with the aim of providing investors with a broader understanding of our business activities, we decided to announce a three-year medium-term management plan (March 2026 to March 2028) and release a video explaining the plan. We will continue to explore a variety of IR methods and strive to further enhance our IR activities.

Sustainability initiatives

In FY2023, we established a Sustainability Committee, identified 11 material issues in FY2024, and are now actively working to address these issues starting in FY2025.

As part of our corporate commitment to society we work to satisfy partners and all other stakeholders through our business activities, while also protecting the global environment as a good corporate citizen. I am confident the Sustainability Committee will further accelerate these programs, helping resolve outstanding issues and enhance corporate value. By contributing to the resolution of diverse social issues we will fulfill our corporate mission and further strengthen the foundation for long-term sustainable growth.

Marketing

In order to achieve the SDGs (Sustainable Development Goals) adopted at the United Nations Summit in September 2015, we will focus on the following social needs, and further contribute to society and business.

Efforts for new product development(SDGs:9.INDUSTRY, INNOVATION AND INFRASTRUCTURE)

As a trading company specializing in machinery, we have matched needs and technologies among our customers and suppliers.

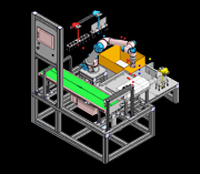

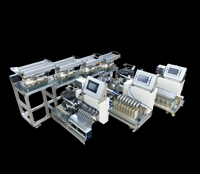

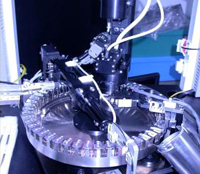

In the industrial machinery business, in response to growing needs for labor saving in the industrial world, we are focusing on the inspection process of various products and discovering excellent venture manufacturers in Japan and overseas.In our construction machinery business, we launched a project team to develop new products and expand into new markets starting in FY2025. Going forward, we will continue to accurately grasp the needs of our customers and strive to expand our products.

Efforts to National resilience(SDGs:11. SUSTAINABLE CITIES AND COMMUNITIES)

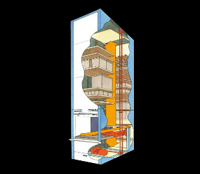

In developed countries, social infrastructure is aging. Conservation of social infrastructure has become a major issue. We sell robots (「NANYO Mall」”e-bi “) that are indispensable for repairing sewer pipes in cities. The domestic market share of robots is about 80%. In the future, the problem of aging sewer pipes is expected to spread not only to large cities but also to local cities. To that end, we will strengthen our organization and develop new products that meet the needs of our customers.

Environmental Initiatives(SDGs:13. CLIMATE ACTION)

In recent years, changes in the global environment have resulted in problems such as global warming and frequent natural disasters.

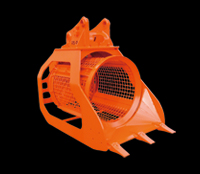

In order to protect the environment, our company acquired ISO 14001 certification in 2002, and has set environmental targets to expand sales of energy-saving, recycling, and other environment-related products. Additionally, in our construction machinery business, we are making steady progress in converting rental machinery to comply with exhaust gas regulations. In the Kyushu region, which is prone to natural disasters, we have a range of machinery available to respond to disaster recovery and national land resilience. Also, starting in FY2025, we begun measuring CO2 emissions and have established a system for appropriate energy management with the aim of reducing CO2 emissions.

Going forward, we will continue to make efforts to promote various environmental initiatives.

Efforts to save labor(SDGs:8. DECENT WORK AND ECONOMIC GROWTH)

One of the social problems in Japan is the declining birthrate and aging population. Even though this problem is becoming more serious, labor productivity in Japan is still low compared to other countries. We are committed to solving this problem by contributing to labor saving.

In the industrial equipment business, we will provide products related to labor saving, such as inspection equipment, by utilizing the know-how we have cultivated over the years in the robot and factory automation markets and the technological development capabilities of our four manufacturing subsidiaries. Furthermore, in our construction machinery business, amid significant labor shortages at construction sites, including for disaster recovery work, we will take steps to establish a framework for actively promoting sales in anticipation of the expected increase in the use of ICT construction machinery.

Finance

Cash flow and business sustainability

We take advantage of our stable financial position to invest in the sustainability and development of our business.

For over 20 years, we have recorded positive operating cash flow and have maintained a healthy balance sheet. We will make capital investment and M & A utilizing this stable cash flow and financial strength to contribute to solving social issues such as changes in the global environment and the declining birthrate and aging population.

We will continue to fulfill our corporate mission by contributing to the resolution of important social issues, aiming for long-term sustainability and further development of our business.

Improving shareholder ROI

To continue to serve all of our stakeholders, the following policies have been implemented for our shareholders.

From fiscal 2024 the payout ratio will be maintained at 35% of consolidated net profit, with stability provided through annual dividend of 20 yen/share regardless of profitability (in the event consolidated net profit is insufficient, the payout will be adjusted downward). From 2015 the company has paid interim dividends and dividends from surplus twice annually to further repay shareholders. From fiscal 2016 we added an incentive for a JPY1000 QUO card to shareholders with 100 or more shares at the close of the fiscal year (JPY1500 if the shares are held for 3 or more years). A stock split was implemented in April 2024 along with other initiatives to improve share mobility and raise share prices in an investment-friendly environment. The coverage and content of the shareholder incentive plan has been continued after the split, representing an effective enhancement to the program.

The management is committed to continued business growth and high ROI.

Accounting

Utilization of new core system

The corporate core system in use for over 20 years has been completely rebuilt, and implemented from fiscal 2023. Designed to facilitate the digital transformation (DX), the new system fulfills customer needs faster than ever through sub-systems including support for transition to cloud service and a range of business intelligence tools. Advanced system functions deliver deeper information analysis, faster decision-making, and more effective business activity. The system is continually upgraded for the latest trends and technologies, providing steady improvement in operations and productivity.

Compliance with International Financial Reporting Standards (IFRS)

More and more businesses are globalized and stock markets are becoming borderless. Investors are now more eager to invest in foreign companies. Accordingly, over 100 countries are already or planning on using IFRS as their domestic accounting standards. In Japan, the government has postponed the start of the IFRS application due to the Great Eastern Japan Earthquake of March 2011. However, the adaptation of IFRS in the future is unavoidable to do business worldwide.

The IFRS is much different from the standards currently used by listed companies including NANYO. Therefore we believe it will take time and effort to comply. We will pay attention to the decisions made by the Financial Services Agency to prepare for IFRS application.