Business Performance

Consolidated Financial Highlights | Charts

* Please see by swiping to the following table.

| Period | 67th | 68th | 69th | 70th | 71st |

|---|---|---|---|---|---|

| Fiscal Ending | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | Mar 2025 |

| Sales (mil, JPY) | 32,406 | 34,818 | 39,339 | 37,991 | 36,535 |

| Ordinary Profit (mil, JPY) | 2,046 | 2,659 | 3,225 | 3,036 | 3,114 |

| Net Income (mil, JPY) | 1,329 | 1,739 | 2,146 | 1,991 | 2,038 |

| Comprehensive Income (mil, JPY) | 1,715 | 1,689 | 2,354 | 2,941 | 1,620 |

| Net Assets (mil, JPY) | 19,565 | 20,880 | 22,723 | 24,692 | 25,663 |

| Total Assets (mil, JPY) | 34,666 | 37,310 | 41,064 | 42,886 | 41,201 |

| BPS (JPY) | 1,536.37 | 1,638.34 | 1,781.20 | 1,977.17 | 2,053.04 |

| EPS (JPY) | 104.42 | 136.52 | 168.31 | 156.60 | 163.09 |

| Capital Adequecy Ratio (%) | 56.4 | 56.0 | 55.3 | 57.6 | 62.3 |

| ROE (%) | 7.0 | 8.6 | 9.8 | 8.4 | 8.1 |

| PER (times) | 8.1 | 6.9 | 6.7 | 8.2 | 7.1 |

| Cash Flow from Operations (mil, JPY) |

5,664 | 2,726 | 1,688 | 5,247 | 4,936 |

| Cash Flow from Investments (mil, JPY) |

-2,946 | -2,332 | -2,846 | -2,452 | -2,182 |

| Cash Flow from Financing Activities (mil, JPY) |

-502 | -619 | -637 | -1,884 | -951 |

| Cash and Cash Equivalents at End of Year (mil, JPY) |

8,161 | 7,971 | 6,192 | 7,123 | 8,972 |

| Employees | 440 | 450 | 475 | 508 | 504 |

Non-consolidated Financial Highlights of NANYO CORPORATION | Charts

* Please see by swiping to the following table.

| Period | 67th | 68th | 69th | 70th | 71st |

|---|---|---|---|---|---|

| Fiscal Ending | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | Mar 2025 |

| Sales (mil, JPY) | 25,323 | 25,904 | 29,579 | 27,131 | 25,834 |

| Ordinary Profit (mil, JPY) | 999 | 1,265 | 1,825 | 1,545 | 1,480 |

| Net Income (mil, JPY) | 686 | 855 | 1,287 | 1,060 | 1,052 |

| Capital (mil, JPY) | 1,181 | 1,181 | 1,181 | 1,181 | 1,181 |

| Stocks Issued (shares) | 6,615,070 | 6,615,070 | 6,615,070 | 6,615,070 | 13,230,140 |

| Net Assets (mil, JPY) | 13,509 | 13,750 | 14,651 | 15,594 | 15,444 |

| Total Assets (mil, JPY) | 25,694 | 26,748 | 29,200 | 30,470 | 28,048 |

| BPS (JPY) | 1,060.79 | 1,078.91 | 1,148.45 | 1,248.68 | 1,235.57 |

| Dividend per share (JPY) | 70.00 | 82.00 | 101.00 | 101.00 | 58.00 |

| (Midterm dividend per share) | 15.00 | 15.00 | 15.00 | 15.00 | 10.00 |

| EPS (JPY) | 53.87 | 67.10 | 100.93 | 83.39 | 84.25 |

| Capital Adequecy Ratio (%) | 52.6 | 51.4 | 50.2 | 51.2 | 55.1 |

| ROE (%) | 5.2 | 6.3 | 9.1 | 7.0 | 6.8 |

| PER (times) | 15.8 | 14.0 | 11.2 | 15.4 | 13.7 |

| Payout Ratio (%) | 65.0 | 61.1 | 50.0 | 60.6 | 68.8 |

| Employees | 157 | 161 | 155 | 153 | 158 |

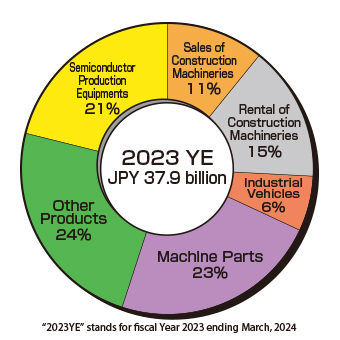

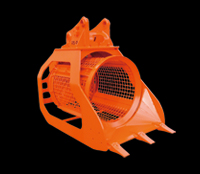

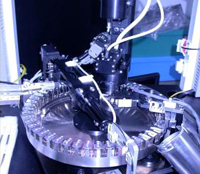

Sales Composition by Lines of Business